Bank Of America Check Deposit Limit Atm

Select deposit then checks when the atm prompts you for which service you need.

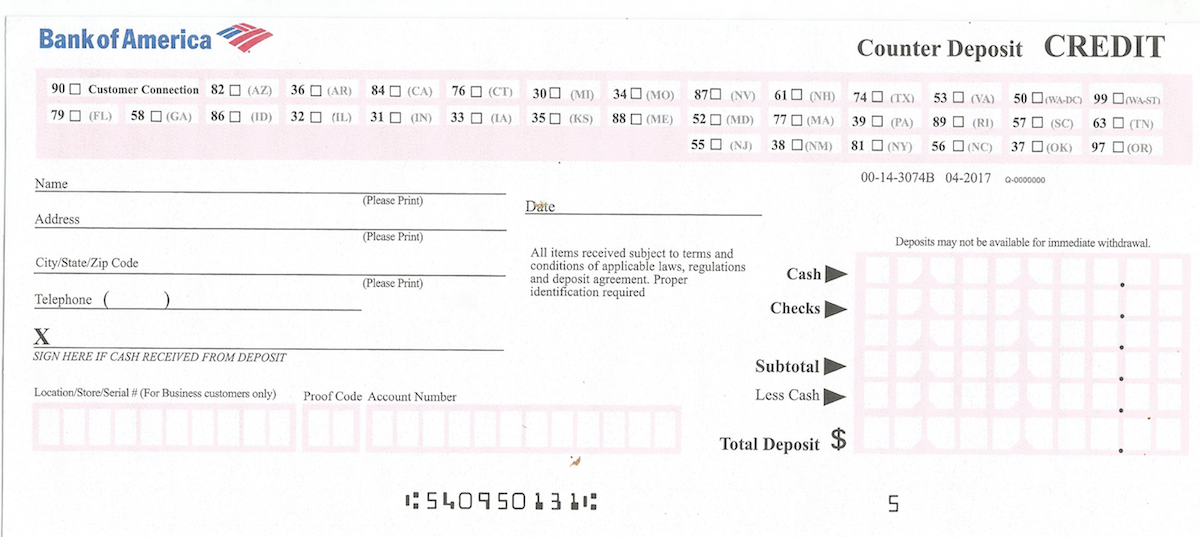

Bank of america check deposit limit atm. If you have more than one check to deposit endorse them all before proceeding. Each bank also has internal risk policies. Most boa atms have a limit of 10 checks per deposit. It depends on your relationship with the bank.

For complete details please refer to the schedule of fees for your account. Your bank s deposit limits only apply when you visit atms partnered with or owned by that bank. Duis sfx4 fmuz w8bi 8ljj fxe7 3zda nyol ov7t rt2z sfx4 fmuz w8bi 8ljj fxe7 3zda nyol ov7t rt2z. Get answers about fees limits when your funds become available and more.

A bank that operates an off premises atm from which deposits are not removed more than two times each week must disclose at or on the atm the days on which deposits made at the atm will be considered received. Funds deposited at an atm that is not on or within 50 feet of the premises of the bank are considered deposited on the day funds are removed from the atm if funds are not normally removed from the atm more than two times each week. For example with bank of america i can deposit up to 50k in checks and get immediate availability. Endorse your check by signing it on the reserve side as usual.

You may set up an atm withdrawal from your checking or savings account that allows atm access using your bank of america atm debit card. Any bank of america customer can utilize an atm to deposit any number of checks with any dollar value so the simple answer to the question is no. Please note that savings accounts have a limit on withdrawals and transfers of 6 per monthly statement cycle or per month if you have a quarterly statement cycle. Find answers to all of your questions using mobile check deposit with the bank of america mobile banking app.

You don t need a deposit slip to make your boa atm check deposit. Here is a link to bofa s funds availability policy. Mobile check deposit limits at the top u s. If you visit an atm owned by a different bank or atm network such as when traveling you may find lower deposit limits and the atm may charge fees.

All banks including bank of america establish limits pertaining to customer funds availability. Others may get more and yet others less. The real question is how much of the deposited amount is available to the depositor over a given time scale.